Asian stocks paused on the final trading day of the year, but investors remain optimistic that the Federal Reserve will begin cutting interest rates in the coming year, potentially ending two years of decline.

The MSCI Asia Pacific index outside Japan was unchanged on Friday at .MIAPJ0000PUS, lingering near a five-month high and on track for a 5% annual gain, a welcome reprieve after two challenging years marked by significant losses.

The index has surged over 11% in the past two months as investors increased their bets that central banks have finished raising interest rates and will soon shift to easing monetary policy.

The probability of the Fed starting rate cuts come March has surged to 88%, up from 35% at the end of November, as indicated by the CME FedWatch. Furthermore, traders anticipate an aggressive easing of monetary policy in the coming year, with over 150 basis points of rate cuts already priced in.

The improved economic data in the US has reinforced the expectation of a change in the Fed’s policy stance, fueling increased bets on rate reductions. While the timing remains uncertain, investors appear overly optimistic about the potential for future rate cuts, raising concerns about potential disappointment in 2024 if the central bank does not meet market expectations.

Vishnu Varathan argues that betting on Goldilocks’ soft landing fueled by US exceptionalism and aggressive rate cut predictions based on the possibility of mistaken disinflation risks could lead to being misdirected. Varathan suggests rate cuts will be measured and gradual, implying a more cautious approach.

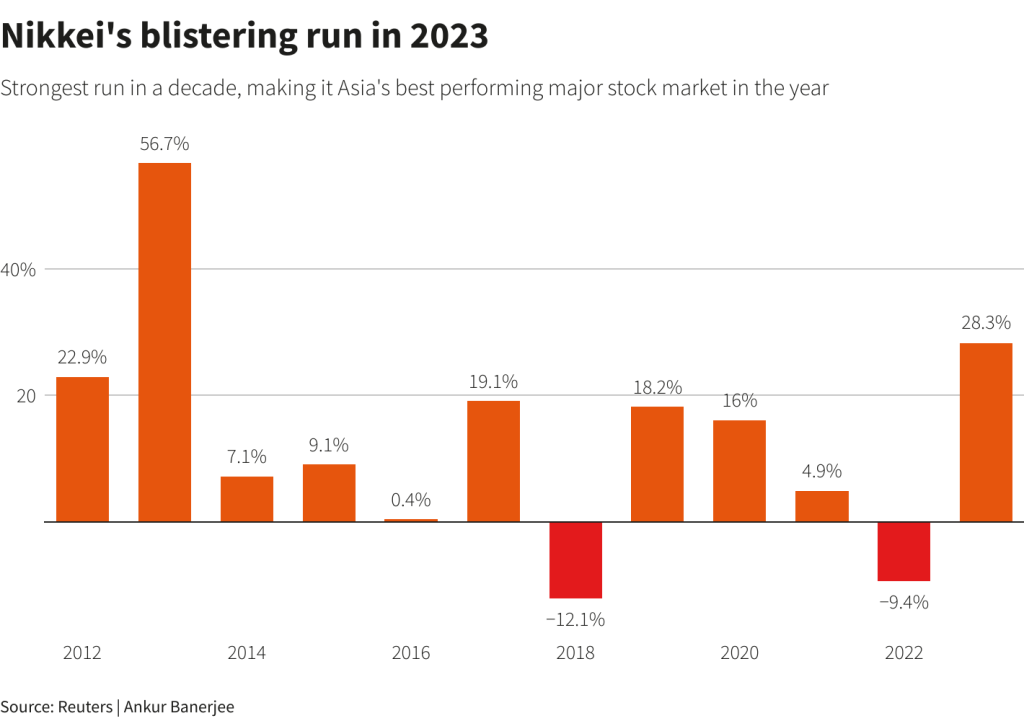

In 2023, Japan’s Nikkei (.N225) was Asia’s top-performing stock market, surging 28% in its most robust yearly performance in ten years. Taiwan’s stock market (.TWII) followed closely, soaring 26.6%, while India’s Nifty (.NSEI) came in third, rising 20%.

In contrast, Thailand’s SET index (.SETI) performed poorly, dropping 15% this year, making it Asia’s worst-performing stock market. Hong Kong’s Hang Seng Index (.HSI) and China’s blue-chip stocks (.CSI300) also struggled, with anticipated declines of 14% and 11%, respectively, by the end of the year.

European stock markets are expected to have a muted end-of-year performance, based on the current futures indicators, as investors focus on consolidating their holdings rather than making any significant moves.

The pan-European STOXX 600 has experienced a remarkable two months, surging an impressive 11% and approaching its 23-month high. Meanwhile, the S&P 500 closed just shy of its record high set on January 3, 2022. Amidst this bullish sentiment, the global bond rally continues to push yields lower, following a prolonged period of rising interest rates that battered bond markets. The yield on US 10-year Treasuries currently stands at approximately 3.84%, after briefly reaching its lowest point since July 19.

In the currency market, the dollar is down 2% this year after two strong years driven by anticipated and actual interest rate hikes by the Fed to combat inflation.

The dollar is currently at 101.50 against a basket of currencies, near its five-month low of 100.61. The dollar’s decline is expected to continue into 2024, especially if the Fed cuts rates early in the year.

However, the strength of the US economy could limit the dollar’s decline. In commodities, Chicago wheat and corn futures are set for their biggest annual decline in a decade due to eased supply bottlenecks in the Black Sea region and increased production, which has put downward pressure on prices.

Cocoa prices reached multi-decade highs in 2023, iron ore surged 50%, and oil prices are anticipated to decline 10% due to fluctuations caused by geopolitical concerns and global anti-inflationary measures. On Friday, U.S. crude oil rose 0.24% to $71.94 per barrel, while Brent increased 0.34% to $77.41.

Gold prices rose, set to conclude their best year since three, with spot gold increasing 0.2% and trading at $2,068.86 per ounce.

+ There are no comments

Add yours