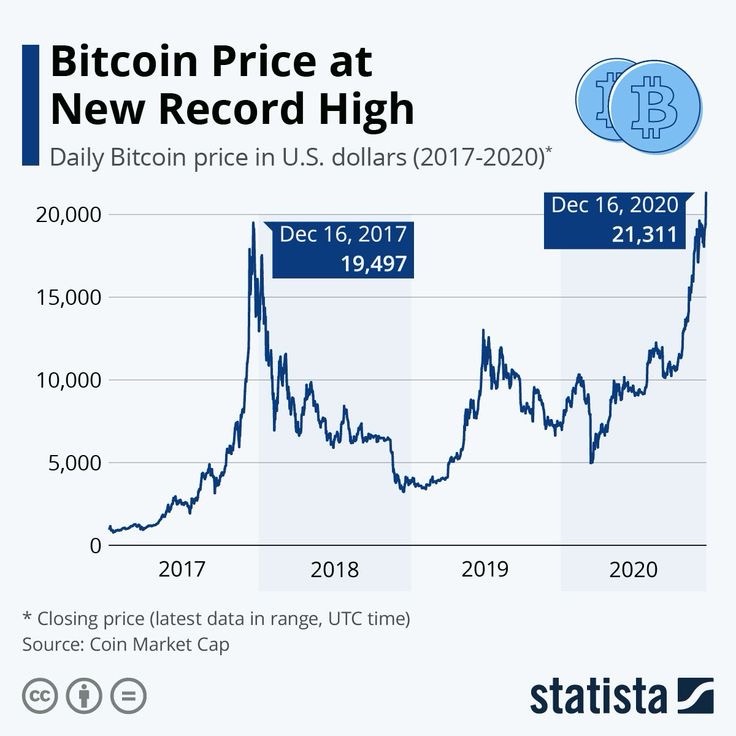

Bitcoin surged to over $67,000, approaching its all-time high for 2021. The cryptocurrency made significant gains at the beginning of the week after a brief pause in the rally over the weekend. Current data from Coin Metrics indicates that Bitcoin was up by 7% to reach $67,379.86, with a peak of $67,567.98 recorded – marking its highest level since November 2021 when it hit its previous all-time high. LFurthermore, Ether also saw a positive trend, climbing 4% and trading close to its January 2022 highs at $3,607.49.

Bitcoin is inching closer to its all-time high price, as the world’s largest cryptocurrency surged past $65,000 for the first time since 2021 on Monday. This milestone places bitcoin on the brink of cementing its remarkable comeback. At late morning trading, bitcoin saw a 5% increase, surpassing $66,000 and reaching its highest value since November 15, 2021. The cryptocurrency is now just under 4% away from its record peak of nearly $69,000 achieved during a fleeting spike in 2021.

The recent surge in bitcoin’s price is largely attributed to the positive sentiment surrounding the newly introduced spot bitcoin exchange-traded funds (ETFs), which have amassed close to $50 billion in assets under management. These ETFs now possess 4% of all bitcoins in circulation, as per data from Bernstein. Additionally, anticipation surrounding an upcoming “halving” event, known to propel bitcoin prices upwards by reducing miners’ incentives and subsequently the supply, has contributed to the rally. A general increase in stock market values has also provided further support to bitcoin’s upward momentum.

As of Monday, bitcoin’s total market capitalization reached $1.29 trillion, according to CoinGecko, a substantial increase from the $320 billion market cap it held at the end of 2022 during the crypto winter. This surge marks a significant milestone in bitcoin’s journey, underscoring its resilience and growing influence in the financial landscape.

+ There are no comments

Add yours